An Update on the Russian Oil Price Cap

In February I posted some figures based on Indian customs data showing importers paying significantly higher than the price cap, in spite of the widespread use of shipping services based in G7 countries. This morning Jim Tankersley reports on the price cap in the New York Times, so here are the updated statistics from Indian customs for the interested reader. My original post included data through December 2022. After changing its website to a numbered ip, the Commerce ministry has updated its figures through March 2023.

Indian Purchases of Russian Crude Continue to Grow

After leveling off at around 35MMbbl/mo at the end of 2022, there has been a significant expansion of Indian imports, approaching 60MMbbl in March. Alaric Nightingale has done some superb reporting for Bloomberg, tracking down the ships that have made this enormous reshuffling of the global oil trade possible. More on that in a sec. India is closing in on buying 50% of its oil from Russia, and 20% of Russian crude exports go to India.

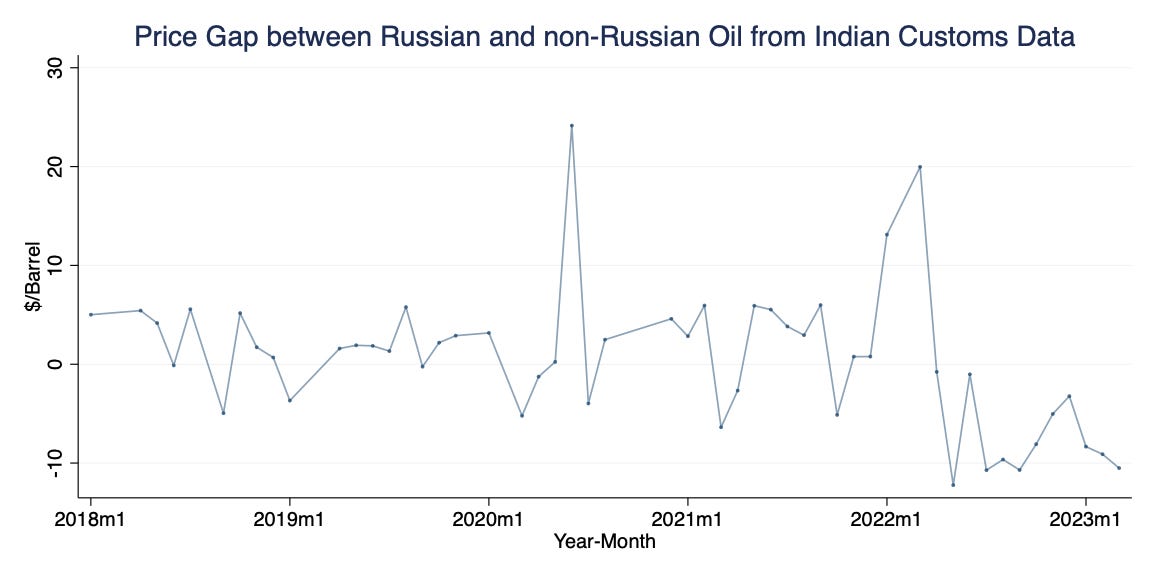

The Price Gap is back to $10/bbl

Indian importers report paying about $10/bbl less for Russian oil than from their other major suppliers. Note that this figure is a bit different than the earlier post, as India has updated its statistics from December. After a few months of narrowed price gaps in late-2022, the gap is back to where it was in the summer of 2022. The latest Urals-Brent price gap is $20/bbl, a benchmark Russia reportedly plans to use for tax purposes.

The administration argues that the price cap is working based on the fact that Indian customs data include transportation costs, and trips from the Baltics are much longer—so a fall in the gap between suppliers (Urals-Brent) and delivery (Indian customs) is to be expected. Fair enough, but how big could that be?

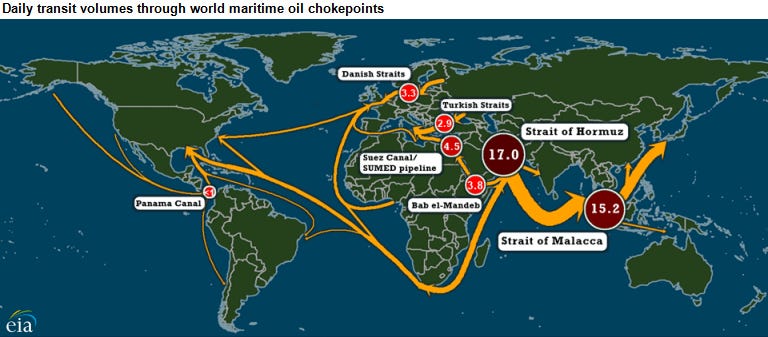

We can get a sense by comparing shipping costs across suppliers: oil from the US, for example, traverses the globe from the Gulf of Mexico, while Saudi oil is more proximate:

And in fact Indian buyers are paying about the same price for US oil as they are for Russian oil (though this is volatile):

With a WTI-Brent gap around $5/bbl, that’s a sensible number to use for the cost of moving oil from the Baltics. The bottom line is that if the gap between Urals and Indian customs reflected shipping costs, there’s a $5/bbl wedge still unaccounted for.

That’s certainly better than the picture from December, but recall it’s now being shared over significantly higher volumes: $5/bbl times 60MMbbl is $300 million per month. Perhaps that wedge is paying higher risk premia to shippers—that would be just fine, as long as the money isn’t going back to the Kremlin.

So who is moving Russian oil? According to the Bloomberg reporting, we know that while the ships are old, the entities on paper are new—and don’t want to be tracked down. We know that Russia has expanded its tentacles into shipping to evade sanctions: In late February the EU sanctioned Dubai-based Sun Ship whose ultimate beneficiary is the the Russian Federation.

And who is buying Russian oil? Well, the second largest refiner in India is Nayara Energy, a now-private company whose ownership structure is at least 49% Rosneft, the Russian state oil enterprise. This means even the $10/bbl discount in the Indian customs data is making its way back to Moscow to an unknown extent.

Talking Points Bingo

When listening to the Administration talk about the oil price cap you’re bound to hear a few key terms dropped in every appearance:

“Twin Goals”

The administration sought to do two things with the price cap, keep Russian oil flowing, and reduce Kremlin revenues (the former is typically called “stabilizing oil markets”). Every time the administration tout the success of the price cap, they are overwhelmingly referring to the former while speaking about the program overall. If press them on it, you get:

“Novel”

This is new. OPEC was deeply concerned the G7 price cap could form the beginnings of a buyers’ cartel to offset the market power of the sellers’ cartel. I certainly hope it does! The fact that the price cap is novel means that it’s unlikely to work well as initially designed. Shouldn’t we innovate as we learn how the Russians are responding? Press a little further, and you get:

“Humble”

It’s quite a trip to go from the end-zone dance in prepared remarks about the price cap’s success to calls for humility during the Q&A, but it comes up just about every time. You’d never know there was such a need for humility at the next appearance, which inevitably begins with triumph all over again.

I do not recommend Price Cap Talking Points Bingo as a drinking game unless you’re looking to revive the three martini lunch of Mad Men days. What I find the most frustrating is that these calls for humility do not appear to translate into any innovation or investment on the enforcement end of things. The EU sanctioning Sun Ship is a great start. But without a significant regulatory effort I do not see how market participants with billions at stake are expected to just leave all this money on the table. Perhaps that’s the point: they’re not.

Instead, the only real goal of the price cap is to keep Russian oil coming out of the ground. The price cap itself is a fig leaf. There was a significant risk of a major disruption in global oil markets if the EU went through with its ban on Russian oil services. The price cap has provided a loophole big enough to sail a tanker through. So we’re pretending to do something about their war chest, but really just preserving the status quo. More stringent enforcement of the cap risks these supplies, so the administration is happy to declare victory and let sleeping dogs lie. As things stand now, it’s Mission Accomplished for the Novel Price Cap (but humble!).